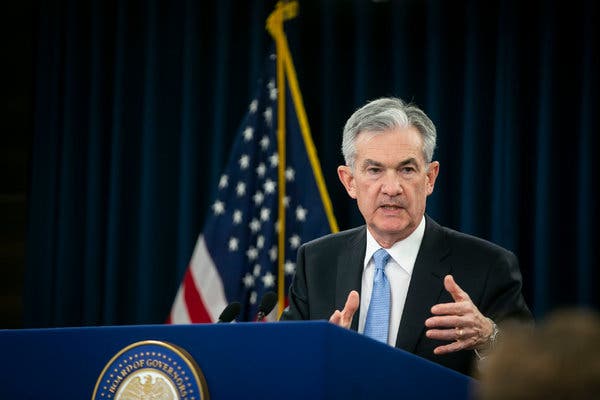

Federal Reserve slashes rates to approximately zero in exigency measures. The Federal Reserve slashes interest rates to approximately zero Sunday an exigency measure that constituted its subsequent endeavor to invigorating an economy that has been devastated by the coronavirus outbreak.

By formulating taking for oneself as contemptible as possible the Central Bank wishes businesses and persons will possess equipped gain to almost interest-free cash to invest and spend.

Succeeding Sunday’s maneuver the contemporary borrowing rate scope is between 0 percent and 0.25 percent.

The measure was meager consolation for markets with Dow coming times instantly diving by approximately 1000 points after the declaration and smashing a limit down margin as traders were perturbed that it abandons the economy out of any bulky ordinance for action for the coming times.

The Fed’s open market committee furnished a statement proclaiming the rate would remain low priced until it is sure that the economy has disintegrated contemporary occurrences and is on track to attain its greatest employment and price firmness goals.

It said it was enacting this because the coronavirus epidemic has injured communities and damaged economic activity in various countries involving the US.

The Fed slashed rates by half a percentage point March 3 the initial exigency rate since the fiscal calamity more than a decade ago. Greg McBride chief financial analyst at Bankrate.com said that despairing times reckons despairing steps, and the Fed is doing just that in an attempt to retain credit markets operating and circumvent the kind of famishing of credit that approximately overturned the global economy into a recession in 2008.

Steve Lopez is the Editorial Page Editor for News Raise. He covers Health. He has won more than a dozen national journalism awards for his reporting and column writing at seven newspapers and four news magazines.